Featured Insights

AI Equity Impact: Already Irrational?

The market may surge in the next few years as AI benefits become clearer and the market prices more of the impact.

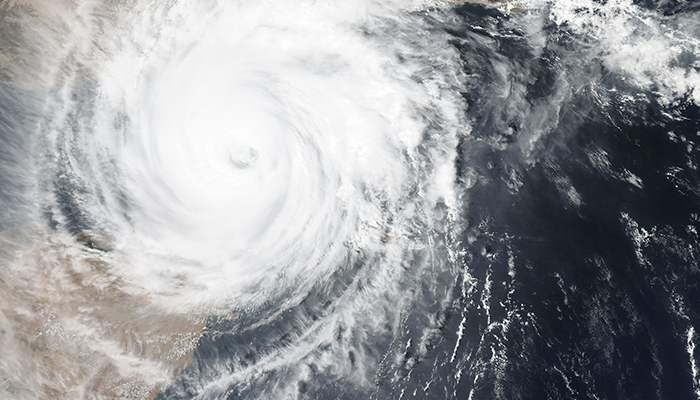

Inflation pressures may grow from Red Sea actions

Chronically constricted Red Sea shipping lanes could raise the cost of Europe-Mid-East-Asia trade and slow the...

Learning from earnings

Q4 earnings faced a low bar and largely underwhelmed, despite modestly beating expectations. The biggest takeaway is...

Japan Macro Update: Yield Curve Control Recalibration Necessary for Policy Sustainability

The Bank of Japan’s experiment with Yield Curve Control and asset purchases is set to wind down. The current framework...

Japan Macro Update: Yield Curve Control Recalibration Necessary for Policy Sustainability

The Bank of Japan’s experiment with Yield Curve Control and asset purchases is set to wind down. The current framework...

China in 2023: Anatomy of a Messy

Re-opening

After an annus horribilis, we expect China’s economy to experience a messy but much needed growth recovery by mid-2023...

The pain in the equity market is likely not over

The market expects the inflation problem to be sorted out by a shallow recession and loosening monetary policy in 2023....

Monthly Market Roundup

February 2024

January Market Roundup

- US equity markets stumbled into the new year but soon recovered and rallied to hit all-time highs later in the month. The US labor market remained healthy, realizing solid ongoing wage gains, low jobless claims, and unemployment at near half-century lows.

- Germany’s manufacturing couldn’t avoid the recessionary storm that the rest of the eurozone barely avoided, seeing weaker industrial demand and a shrinking economy. The European Central Bank’s (ECB) quarterly meeting in January unsurprisingly left rates unchanged.

- China’s fourth-quarter real GDP growth fell mildly short of expectations, but the annual print was in line. Full-year growth, of 5.2%, managed to edge past the “around 5%” growth target. However, China’s nominal GDP expanded only 4.2% — highlighting economy-wide deflation. Chinese authorities began stepping up market support and easing policies more notably. While this will help shore up sentiment, China needs a much larger fiscal push directed at consumers.

Points of View

Points of View: On the cusp of a productivity boom?

The promise of AI (and other reasons for optimism)

Japan: Further tweaks to YCC

Japan's incipient wage-price spiral to spur further tweaks to yield curve control policy.

Japan: Yen in a Free Fall, but a Policy Pivot is Nearing

Describes how global policy divergence and other macro-drivers of large-scale Yen depreciation are still intact, but...

Elevated Sino-US Tension over Taiwan to Accelerate Economic De-Coupling

The Taiwan related tension may not go away quickly with the upcoming quinquennial transition in China and US mid-term...

Elevated Sino-US Tension over Taiwan to Accelerate Economic De-Coupling

The Taiwan related tension may not go away quickly with the upcoming quinquennial transition in China and US mid-term...

Food Price Shocks: Macro and Investment Implications

This note details our latest analysis of prolonged food price shocks and their impact on macro and investments.

Bear Markets: More Pain, Then Gain

The history of bear markets makes for gloomy reading. However, this brief note focuses on what we might expect once the...

Don’t Blame China for Inflation Damage in the U.S.

The state of global supply chains are widely seen as heavily influenced by developments in China. While it is true that...

A Deep Dive into QT

In this third note of three, we review the arguments behind these opposing views in the previous two, in the hope to...

Could QT lead to a steeper yield curve?

In the first note in a series of three on QT we argued that QT will most likely contribute to a flattening of the yield...

The Impact of QT on Financial Markets

We have written extensively on our expectations for future rate hikes and the peak in US rates. In this paper, the...

Yield Curve Inversion... This Time Is Not Different

We believe the possibility of a recession in the US over the coming two to three years is increasing. As such, we take...

Global Economics and Investment Analysis Group

Meet the minds behind the research.

MARK-487914-2024-01-24